Yellen Warns: U.S. Debt May Collapse

Image Source: Sourced from the Internet

As the saying goes, the dollar is also a success, and the dollar is also a failure. Had with the dollar hegemony on sale of U.S. bonds home, the United States, probably would not have thought that now the U.S. economic building will be tilted, but also the U.S. dollar. At the beginning of August, the other side of the ocean came one after another bad news from the United States, U.S. non-farm payrolls data cold, the stock market plunged, the dollar accelerated weakness, and now, the United States interest rate cuts have become a foregone conclusion, the United States and the United States of America is about to come to an end of the financial war, and at such a critical moment, Japan backed into the water, announced that it would raise interest rates. China reduced its holdings of U.S. property accumulated 228 billion, the United States today's situation can be described as four-sided, in the face of the high base of debt, the United States and where will it go? At the same time, August 16, data show that China again increased its holdings of U.S. debt amounted to 11.9 billion U.S. dollars, the purpose behind it is obvious.

The so-called everything in the world is in the process of change, the rise and fall of honor and disgrace, there is no fixed number. At the beginning of the United States will not be expected, the use of the dollar interest rate hike attempt to harvest the world, and now they are in the dollar roundabout knife, when the U.S. stock market plunged, non-farm payrolls data amounted to a cold, the dollar weakened rapidly, in the triple blow, the former allies diving, former rivals to reduce the holdings of the United States, the U.S. will not regret what was done at the beginning of it?

Image Source: Sourced from the Internet

In 2018, the United States watched the rise of the lion of the East, which inspired the United States' sense of danger, and a unilateral trade war was launched, followed by a technological war, a chip war, and the recent financial war. Maybe it is favored by God, the United States opened a trade war against China, technology war, chip war, not only did not beat China down, on the contrary, turn the pressure into power, accelerated the development of China in the field of suppression, and now, even the protracted financial war is about to come to an end.

The United States by virtue of the supremacy of the hegemonic position of the dollar, the global issuance of U.S. Treasury bonds, access to a large amount of wealth, but also by virtue of the existence of the dollar and U.S. debt. The United States has emerged unscathed from many financial crises around the world, but this time, the loser of the financial game provoked by the United States against China seems to have become itself. Up to now, the dollar has accumulated 11 interest rate hikes, and in the process of the dollar's interest rate hike, the U.S. has once again gained access to funds, however, fate is always so fond of jokes, and today the U.S. is also dragged down by the dollar's interest rate hike.

Image Source: Sourced from the Internet

While maintaining high interest rates, and at the same time a large number of debt issuance, today's U.S. national debt has broken through to the 35 trillion mark. According to U.S. media statistics, today's high U.S. debt and high interest rates, making the U.S. yearly interest payments amounted to more than a trillion dollars, this value may be fast catching up with the GDP of some small countries a year, the U.S. year one-third of the tax revenue to be used to pay the interest, in the long run, the United States, how can be suffered. What's more, today's U.S. manufacturing and service sectors are slowing down, the unemployment rate has reached the critical value of Sam's Law, and non-farm payrolls data is to the U.S. economy poured a pot of cold water, the U.S. stock market plummeted, the U.S. today in the United States want to maintain high interest rates, is simply suicidal.

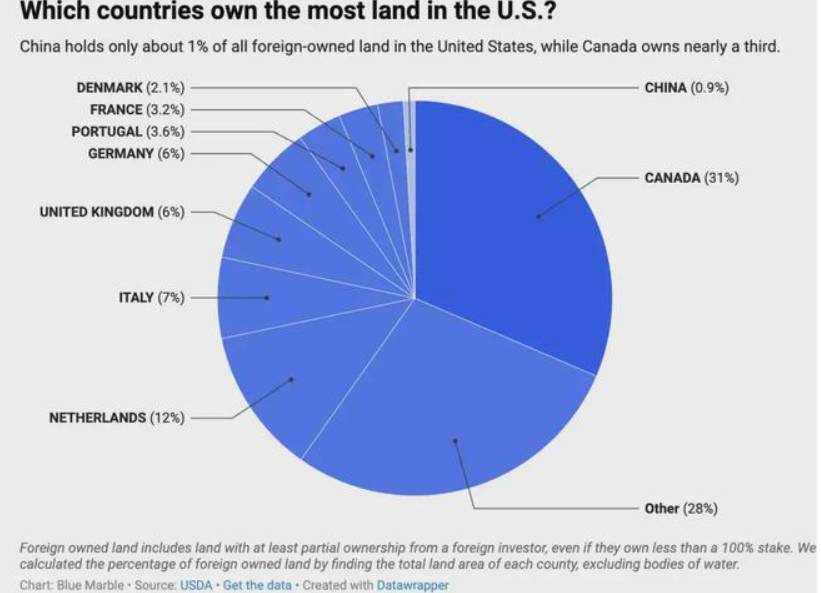

What makes the United States worse is that former allies Japan and China seem to be on a united front. Following China's last frantic reduction in its holdings of U.S. debt, China has thrown in the towel this time around. According to a report by Real Capital Analytics, a U.S. real estate data analyst, updated on Aug. 1, we've seen that over the past few years, our clients have been big investors in five-star hotels and big shopping malls in the U.S., mainly buying properties in Florida and California. However, the situation seems to be different now.

Image Source: Sourced from the Internet

Former Chinese buyers (both individuals and companies) have been selling their US properties early since March 2022, when the Federal Reserve raised interest rates. Since the second quarter of 2022, they've sold off at least about $31.7 billion (roughly equivalent to RMB 228 billion) of U.S. commercial real estate, a figure that's a full 15 times greater than what they purchased over the same period. And Japan kicked off its own counterattack after the Fed announced that it would not cut interest rates again in August.

On the last day of July, when everyone is concerned about the Olympic Games in Paris, Japan, the world's largest holder of U.S. Treasury bonds, even to move to the U.S. dollar sword, the news is as shocking as an eagle's cry, they even began to raise interest rates sharply without warning, this wave of operation is faster than lightning. This is not a joke, Japan's interest rate hike is likely to trigger a huge earthquake in the global financial markets, the United States and European stock market prices have to readjust.

Image Source: Sourced from the Internet

After all, in the past decade or so, global investors have been borrowing hard to Japan's cheap currency, because it can produce Japan and the United States and Japan and Europe spread effect. But now, as soon as Japan began to raise interest rates, this situation is going to change radically, millions of billions of dollars of U.S. and European funds will have to obediently return to Japan.

Financial guru Peter Schiff in the August 2nd update of the research report in-depth analysis of this issue, he believes that if the U.S. asset price market in a large-scale collapse, then in the banking crisis and recession under the double pressure, the world's major central banks may accelerate the sale of the hands of the U.S. bond holdings, and investors may also be ready to press the sell button. Considering the historical lesson that the United States has experienced two technical defaults, this could lead to at least $35 trillion of international capital to start withdrawing from the United States, which may flow to other countries or markets, such as U.S. Treasuries, real estate markets, and bank savings, among others. At the same time, many smart international investors have already looked East, looking for emerging markets that offer higher returns.

And the U.S. stock market crash has proven just that. Now the U.S. has been turned its back by many countries, the U.S. stock market has plummeted, and the U.S. debt is high.

Image Source: Sourced from the Internet

Increase holdings of $11.9 billion is the so-called lifting a stone to stone their own feet, the United States is now really success is also the dollar, also lost the dollar. In the past few decades of development, the United States frequent sale of treasury bonds to obtain a lot of wealth, but there is no free lunch, now the U.S. domestic economic situation is grim, a large number of capital to escape, the number of unemployed people climbed, the current U.S. debt is facing the danger of collapse. In this case, China has bucked the trend by reducing and increasing its holdings by $11.9 billion, what is the purpose behind it?

Image Source: Sourced from the Internet

We reduce investment in U.S. bonds mainly considering the following points: first of all, we have to talk about the issue of the U.S. dollar interest rate hike, the higher the interest rate of the U.S. dollar the cheaper the yuan in exchange for U.S. dollars, in order to maintain the stability of the exchange rate of the yuan, we can only buy back more yuan through the use of U.S. dollars from overseas; furthermore, because of the increase in the interest rate led to the extension of the domestic real estate owners of the U.S. dollar debt in heaps, and they have these loans business basically have to be by the our national bank to provide guarantees, so that in turn cost us a lot of dollars, so we had to buy fewer U.S. bonds.

Image Source: Sourced from the Internet

And then, since the war started in Russia Ukraine, the U.S. has imposed a series of financial blockades on Russia, including freezing Russia's foreign exchange reserves and kicking it out of SWIFT, the dollar payment system, and we in China are worried about that, and not only that, but there's been varying degrees of de-dollarization going on all over the world. Our massive reduction in purchases of U.S. bonds, along with an increase in gold holdings, is our direct response to this.

Image Source: Sourced from the Internet

Further, our reduction in purchases of US bonds is a long term process, while the increase in holdings is only temporary, for example, in 2023 there was a reverse operation for three consecutive months, one during the Silicon Valley banking crisis and the other during the San Francisco meeting, the first time obviously to cash in on the profits, and the second time for political reasons, we needed to save face for the US. So why did we increase our purchases of US bonds this time? The simple answer is because the US dollar is about to cut interest rates and we need to get ahead of the game. With the general rise in the price of US Treasuries in June, followed by the expectation of interest rate cuts and global financial market shocks, and the big rise in US bonds in July and August, this is the right time for us to buy, which can be thought of as for short-term profits.

Image Source: Sourced from the Internet

For a long time, the United States has been dominated by itself, the implementation of the dollar-dominated world monetary system, but also pulled the whole world into its debt trap. This way, as long as the US economy is doing well, they can utilize this advantage to easily ride out the storm. However, once the U.S. debt accumulates to a point where the government cannot afford it, then the international financial market will have to suffer. With such a high debt, the United States also initiated a financial war with China in an attempt to use interest rate hikes to harvest China and break its economy.

Image Source: Sourced from the Internet

But they have forgotten that, first of all, is not finance an accessory to trade? Indeed, the United States has an unrivaled hegemony of the dollar, but China has the world's most robust manufacturing system, which allows China's trade to maintain a long-term surplus in the hands of up to 3 trillion U.S. dollars in foreign exchange reserves, so that the United States wants to influence our country's exchange rate through the application of pressure, it is really more difficult than the sky.

Image Source: Sourced from the Internet

Secondly, the United States does not seem to fully realize that its own aggressive interest rate hike policy may put its partners under the wall of danger, pushing them hard to the edge of despair, and finally may even lead to their choice of betrayal and boycott. Japan is a good example of this. In fact, as early as about two or three months ago, Ms YELLEN of the United States Treasury Department warned that if we continued to maintain such high interest rates, we might bring the United States national debt to the point of collapse.

But she didn't realize that the U.S. economy was on a wild goose chase. The U.S. stock market has plummeted, and even tech giants like Nvidia and Tesla, which the U.S. prides itself on, have seen their stock prices drop by more than 10 percent.

-------- END --------