Qcells Receives $1.45 Billion Loan for Georgia Plant

Image Source: Sourced from the Internet

Hanwha Qcells has received a conditional commitment from the U.S. Department of Energy (DOE) for a $1.45 billion loan for its vertically integrated photovoltaic (PV) manufacturing facility in Cartersville, Georgia. The loan will be used to support the construction of the plant, which is planned to total more than $2.5 billion for the production of ingots, slices, cells and modules. Disbursement of the loan will be subject to Qcells meeting certain technical, legal, environmental and financial conditions.

The plant is scheduled to be operational by the end of 2024, with the goal of establishing a complete solar supply chain in the U.S. Qcells' existing plant in Dalton, Georgia, already has an annual capacity of more than 5.1GW, including the addition of 2GW in October 2023. by the end of 2024, the total annual PV manufacturing capacity of the Cartersville and Dalton plants is expected to reach 8.4GW.

Image Source: Sourced from the Internet

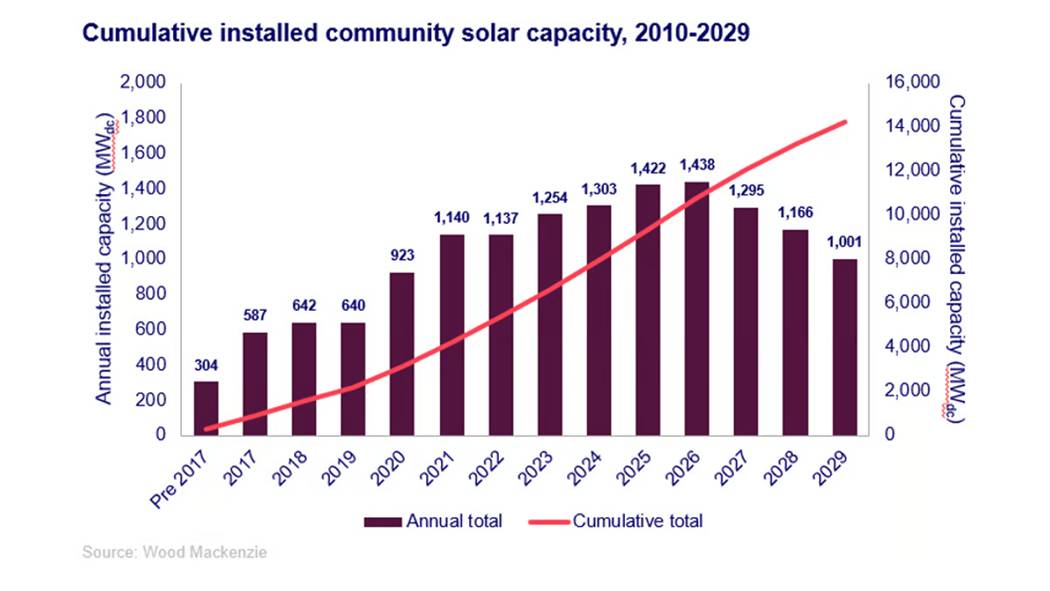

Wood Mackenzie: National community solar installations to exceed 14GW by 2029

According to a report by Wood Mackenzie and CCSA, the U.S. community solar market is poised for growth supported by existing mature markets, with 14GW of cumulative DC-side installations to be realized by 2029. (Image credit: Wood Mackenzie)

According to a new report from Wood Mackenzie and the Coalition for Community Solar Access (CCSA), the U.S. community solar market is projected to add 7.3GW (DC) by 2029, bringing the market to a cumulative 14GW of installed capacity.The new installations will primarily come from New installations will come primarily from existing mature markets, but as these markets become saturated, the CAGR is expected to decline from 5% in 2026 to -11% in 2029.

The report notes that future growth in the community solar market will depend on the introduction of new state legislation, particularly in promising new markets such as Ohio, Pennsylvania, Michigan and Wisconsin. If these states adopt supportive policies, the forecast cumulative market capacity in 2029 could increase by 17% to 17.1GW.

Additionally, community solar will provide 3.6GW of generating capacity to low- and moderate-income (LMI) customers by 2029, a significant increase from 829MW in the first quarter of 2024. LMI customers are expected to increase their share of the community solar market to nearly 25 percent by 2025.

However, the report notes that the cost of acquisition for LMI subscribers remains high, averaging $113/kW, which is 27% higher than for non-LMI subscribers. Outsourcing customer acquisition to a third party may help developers reduce these costs.

Image Source: Sourced from the Internet

AGL Acquires 8.1GW Portfolio of Renewable Power Projects in Australia

AGL acquires Terrain Solar and its sister company Firm Power in preparation for a decoalition future. (Illustrative photo credit: Dr. Victor Wong/Shutterstock.com))

Australian power company AGL Energy Limited has signed a binding agreement with solar project developer Terrain Solar and its sister company Firm Power, a developer of battery energy storage systems (BESS), to acquire 100% of the companies for $250 million and from them an 8.1GW portfolio of renewable energy projects. renewable energy project portfolio from them. The transaction significantly increases AGL's project portfolio from the current 6.2GW to over 14GW.

The acquisition includes 1.8GW of solar projects in New South Wales (NSW), Queensland, Western Australia and South Australia; 6.1GW of grid-scale energy storage projects, of which 21 are under development; and 250MW of onshore wind projects in NSW.

AGL aims to add 12GW of renewable capacity and consolidate capacity by the end of 2035, when it will exit the coal-fired generation business.

-------- END --------